Other service providers

We open the banking interface to other payment service providers (so-called third parties). Using the technical interface (API - Application Programming Interface) third-party developers can combine their applications with bank data and provide a payment initiation service and account information service, thereby fulfilling the legal duty of the bank to allow third parties access to VÚB clients' payment accounts. These services do not replace the services provided by banks, but are new payment services that other payment service providers, such as the bank, may also provide in relation to payment accounts held at the bank

Who are the other payment service providers?

On 13 January 2018, the amendment to Act No. 492/2009 Coll. on payment services and on the amendment of certain acts implementing Directive 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market - PSD2 (Payment Services Directive 2) enters into force. These legislative changes bring, among other things, new payment services that can be provided by payment service providers under a license granted by a competent national authority within the European Union. The conditions for granting such a license are in the national legislation.

Other payment service providers may provide the following services from 13 January 2018:

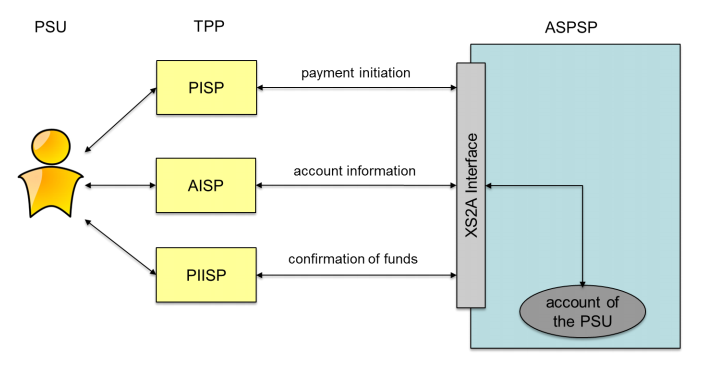

- Payment initiation services – Placing of payment orders to the bank through a provider of payment initiation services from a client's payment account held at a bank to which the client grants explicit consent. The condition of using this payment service is the availability of the client's payment account in the online environment.

- Account notification service – This is an online service that provides the client with a consolidated account of his/her accounts held in various banks via the Internet or another electronic distribution channel. The service is provided by the Provider of Account Information Services after the client has given his/her consent to this Provider. The condition of the use of this payment service is the availability of the client's payment account in the online environment.

Through the technical interface, inter alia, VÚB will provide information on the availability of funds to the client's account to the Payment Service Provider issuing the payment facilities linked to the payment card to the account, based on the client's consent to VÚB Bank. From 13 January 2018, if the client grants VÚB Bank a prior approval, the bank shall respond to this provider upon request for confirmation of the amount of the balance on the client's account, using only the Y/N response, without blocking the funds on the client's account.

VUB PSD2 API

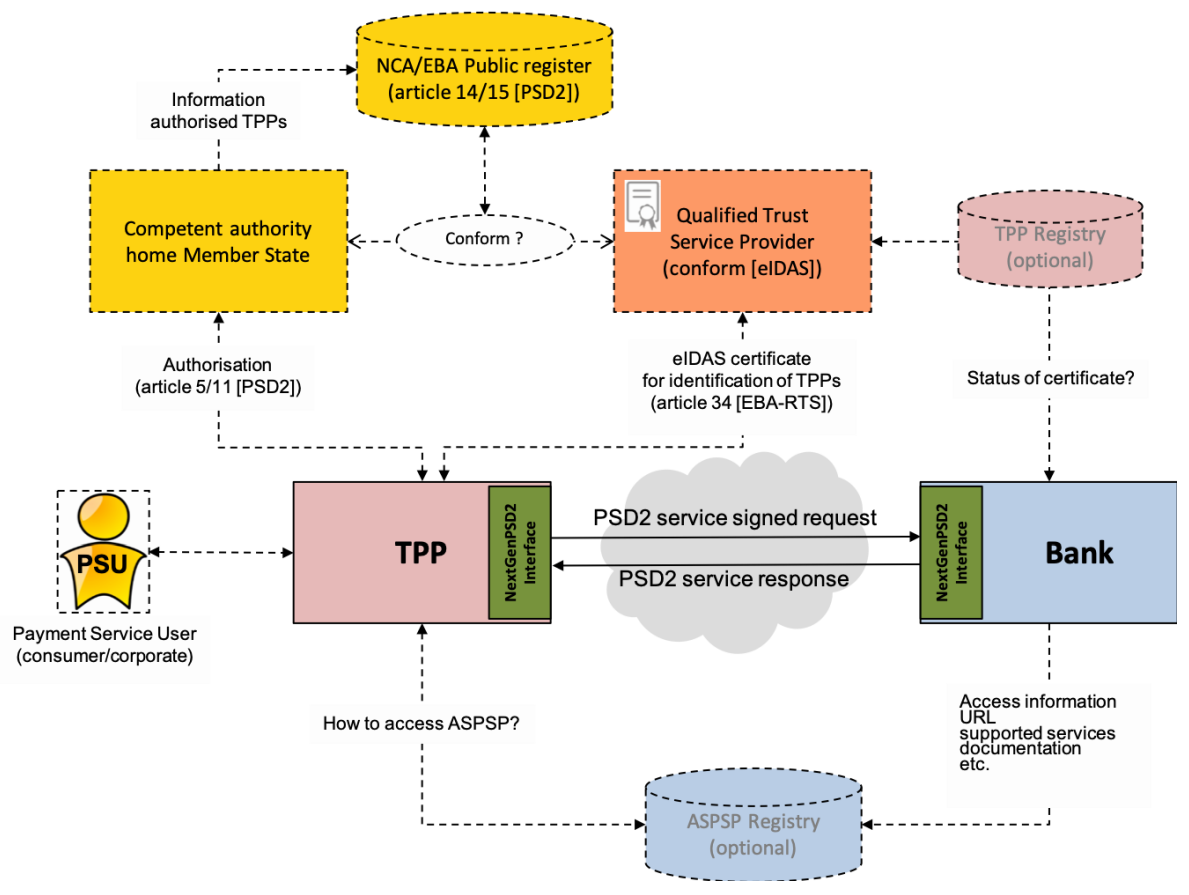

Since 1st of March 2023, VUB as the member of ISBD (International Subsidiary Banks Division) is aligned with the group through Open Banking activities and support of group Developer portal and API standard coming from Berlin-group NextGenPSD2 XS2A Framework (Berlin-group standard).

For regisration, you may use our group Developer portal (“ISBD Open Banking Group Application”): https://isbd.openbanking.intesasanpaolo.com/en/home which can be used by both licensed and unlicensed TPPs. This portal offers capability for test certificate generation, ticketing system for all TPP requests and documentation including OpenAPI3 specification.

TPP Introduction

Application programming interfaces

for access to the Account Information Services and Payment Initiation Services, compliant with the new Payment Services Directive (PSD2), the regulatory technical standard for strong customer authentication (SCA) and open programming interfaces and the local Slovak legislation, transposing the PSD2 directive into local law.

Legal introduction

Všeobecná úverová banka, a.s. (“VUB”) enables access to accounts (XS2A) utilizing REST API services compliant with The Berlin Group NextGenPSD2 standard version 1.3.9 (shortly to be upgraded into version 1.3.11) that is further defined in implementation guidelines.

Access to the API can be requested by any natural or legal person that has the right to API access based on either the:

- Directive (EU) 2015/2366 of the European Parliament and of the Council of November 25th 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC (PSD2);

- Commission Delegated Regulation (EU) 2018/389 of November 27th 2017 supplementing Directive (EU) 2015/2366 of the European Parliament and of the Council with regard to regulatory technical standards for strong customer authentication (RTS SCA) and common and secure open standards of communication (RTS SCS);

- Act no. 492/2009 Coll. on payment services and amendments to certain laws

This means particularly:

- Third Party Payment Service Providers that have been registered by a competent authority in the EU;

- Third Party Payment Service Providers that are in the process of being registered by a competent authority in the EU.

Required onboarding process

Open ID registration throught exposed register API. OpenAPI3 specification is available at group Developer portal.

Optional onboarding process

1. TPP registers on https://isbd.openbanking.intesasanpaolo.com/en/sign_up. For a successful registration you should select either:

a. I'm registered TPP: In this case you should upload public part of a production eIDAS certificate issued by a verified QTSP.

b. I'm in registration process: In this case you should upload either:

i. Documentation that proves your TPP registration with a relevant NCA.

ii. Documentation that proves you are in the process of obtaining a TPP registration with a relevant NCA and it is likely that you will obtain such registration.

2. TPP receives email notification of successful registration.

3. TPP receives email notification about successful validation of registration, with a password for ISBD Open Banking Group Application

4. TPP logs into ISBD Open Banking Group Application and retrieves certificate and password for Sandbox API.

5. TPP tests Sandbox API.

6. TPP starts using Real API.

Technical

Overview

XS2A interface

Access points

Sandbox API base URL: https://api.vub.sk with the http request header attribute "X-PSD2Sandbox" set to "yes"

Real API base URL: https://api.vub.sk/

Account Information Service (AIS)

- GET /v1/accounts

- GET /v1/accounts/{accountId}

- GET /v1/accounts/{accountId}/balances

- GET /v1/accounts/{accountId}/transactions

- GET /v1/accounts/{accountId}/transactions/{resourceId}

- POST /v1/consents

- GET /v1/consents/{consentId}

- DELETE /v1/consents/{consentId}

- GET /v1/consents/{consentId}/status

Payment Initiation Service (PIS)

- POST /v1/payments/{paymentProduct}

- POST /v1/periodic-payments/{paymentProduct}

- POST /v1/signing-baskets

- GET /v1/payments/{paymentProduct}/{paymentId}

- GET /v1/periodic-payments/{paymentProduct}/{paymentId}

- GET /v1/signing-baskets/{basketId}

- DELETE /v1/payments/{paymentProduct}/{paymentId}

- DELETE /v1/periodic-payments/{paymentProduct}/{paymentId}

- DELETE /v1/signing-baskets/{basketId}

- GET /v1/payments/{paymentProduct}/{paymentId}/status

- GET /v1/periodic-payments/{paymentProduct}/{paymentId}/status

- GET /v1/signing-baskets/{basketId}/status

Confirmation of Funds Service (PIIS)

- POST /v1/funds-confirmations

Planned deployments and maintenance

Unexpected events and reported errors announcements

Berlin Group NextGenPSD2 Standard

Statistics